Performance-based management fees allow you to charge a set percentage of all portfolio gains for the period. To create a performance-based management fee, do the following:

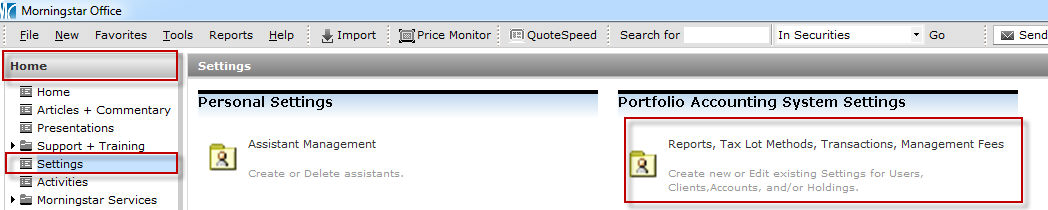

Go to the Home tab.

Click the Settings page.

Under the Portfolio Accounting System Settings area, click Reports, Tax Lot Methods, Transactions, Management Fees. The Settings dialog box opens

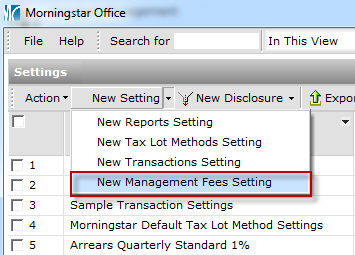

On the icon bar above the spreadsheet area, click the arrow to the right of the New Setting button and select New Management Fees Setting. The Management fee setting dialog box opens.

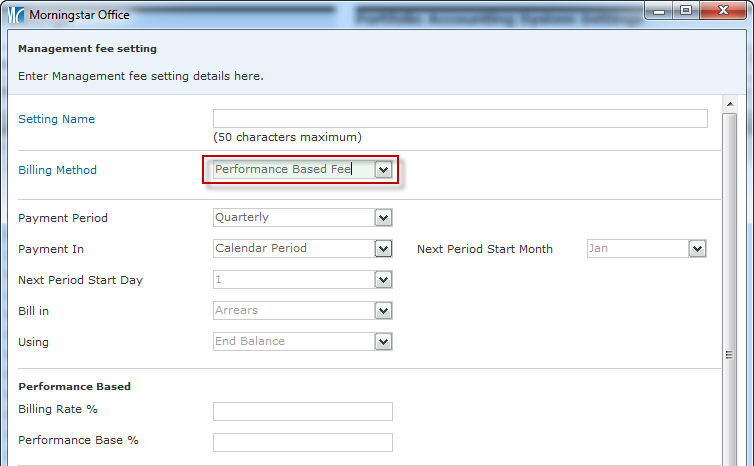

Use the table below for instructions on how to fill out the fields in this dialog box.

| Field Name | Instructions | |||

| Setting Name | The name of the management fee setting. This does not appear on any reports; it is for internal use. Most advisors choose a descriptive name. For example: “Standard Performance Fee.” | |||

| Billing Method | Select Performance Based Fee. | |||

| Payment Period | This field determines the billing time period. The options are Quarterly, Monthly, Semi-annual, Annual or Custom Period. If Custom Period is selected, the client can be billed in either 2- or 4-month periods. | |||

| Payment In |

Select Calendar Period or Rolling Period. With Calendar Period, accounts are billed on the last day of the month/quarter, according to conventional calendar periods. With Rolling Period, accounts are charged on a date of your choosing. Quarter start and end dates follow your custom schedule. |

|||

| Next Period Start Month (Rolling Period Only) | This field is used only when the Payment In field is set to Rolling Period. It determines the month when the next period in the cycle begins. For example, if the next billing period begins on February 15, select Feb. | |||

| Next Period Start Day (Rolling Period Only) | This field is used only when the Payment In field is set to Rolling Period. It determines the day when the next period in the cycle begins. For example, if the next billing period begins on February 15, select 15. | |||

| Bill In | When using a performance-based fee, you will always bill in arrears. This field defaults to that value, and cannot be changed. | |||

| Using | When using a performance-based fee, you will always use the ending balance for a time period. This field defaults to End Balance, and cannot be changed. | |||

| Bill Rate % |

The percentage of a portfolio’s total investment gain (expressed as total dollar value) that constitutes the management fee for a period. For example, if a client’s account gains 10% in a period and that 10% gain results in a $2,000 gain, your Billing Rate would be a percentage of this $2,000. Only gains can result in fees; losses would result in a $0 fee. The formula used to calculate a portfolio’s total investment gain during a period is: Where: A = Ending Portfolio Market Value B = Beginning Portfolio Market Value, and C = Net Cash Flow |

|||

| Performance Base Percentage |

An optional performance threshold that limits the management fee calculated. The performance-based fee charged will reflect only the investment gain amount above the performance base. For example, if you enter the number 2 here, then an account will be billed only for the gains it makes in excess of that amount. The formula used to calculate the performance-based management fee is:

Where:

Here’s an example using this formula: A client’s portfolio has a market value at the beginning of the period of $100,000. They make no additions or withdrawals during the period, so D = $100,000. The performance base % is 2%, so F = $102,000. ($100,000 X (1+0.02)) The billing rate % is 5%, and the ending market value is $105,000. Therefore, the performance-based fee is $150. (0.05 X ($105,000 - $102,000)) |

|||

| Annual Minimum Fee | Enter a dollar amount here to ensure that a certain annual minimum fee is charged to an account. | |||

| Billing Disclosure | If desired, select a custom disclosure to appear on the Billing Summary. You must have already created and saved a billing disclosure before you can select it here. See “Creating a Billing Disclosure” on page 18. | |||

| Exclude Accrued Interest | Check this box to exclude accrued interest from bonds in the billable balance of your accounts. | |||

| Management Fee Deductible from Custodian Account | This check box determines the content of your billing summary. If the box is checked, the billing summary will show that the client owes nothing because fees are deducted automatically. If the box is unchecked, the Billing Summary will show a balance due. |

Click Save + Close