This topic covering the reclassification of assets pertains to the Current vs. Target Asset Allocation Report, Current vs. Model Portfolio, Security Reclassification, and Planning areas of the system.

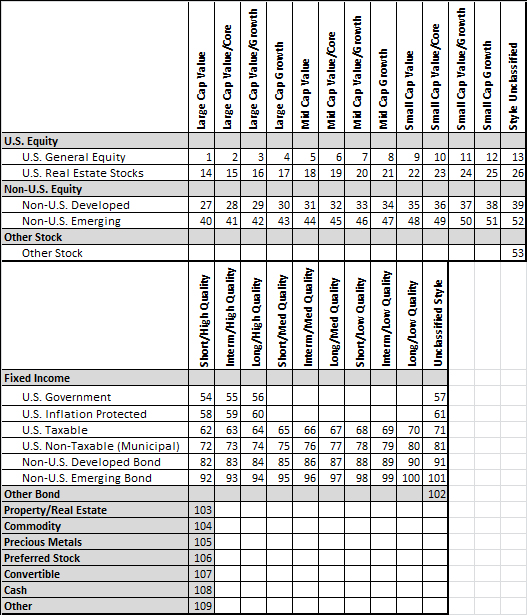

Using the category numbers from the table above, securities are classified into the Morningstar Expanded set of asset classes as follows:

|

US Large Cap Growth |

3,4 |

|

US Large Cap Value |

1,2 |

|

US Mid Cap Growth |

7,8 |

|

US Mid Cap Value |

5,6 |

|

US Small Cap Growth |

11,12 |

|

US Small Cap Value |

9,10 |

|

Non-US Dev Stock |

27-39 |

|

Non-US Emrg Stock |

40-52 |

|

US Txbl Long Term Bonds |

56,64,67,106 |

|

US Txbl Int Term Bonds |

55,63,66 |

|

US Txbl Short Term Bonds |

54,62,65 |

|

US Infl Protected Bonds |

58-61 |

|

US Tax-Exempt Bonds |

72-81 |

|

US High Yield Bonds |

68-70 |

|

Non-US Dev Bonds |

82-91 |

|

Non-US Emrg Beonds |

92-101 |

|

Cash |

108 |

|

Real Estate |

14-26,103 |

|

Commodities |

104,105 |

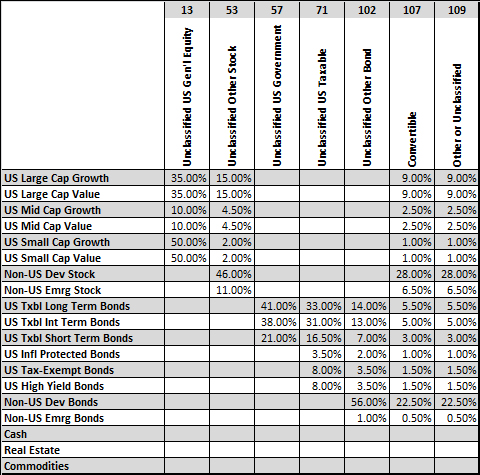

Any holdings that are unclassified, classified as "Other" (category 109), or fall into one of the partially-unclassified categories (13 ,53, 57, 71, 102, and 107) will be divided among the 19 asset classes according to the following chart: