Overview

When importing, corporate action transactions (such as spin-offs) are often flagged and located at the top of the Transactions blotter. You won’t need to use these transactions, since they will be re-created and accounted for by the Spin-off Wizard. Before you use the Spin-off Wizard, you should export transactions pertaining to a spin-off to an Excel spreadsheet for reference later, and then delete those transactions.

If you already posted the spin-off transactions to your clients’ accounts, export them to an Excel spreadsheet from the client’s account(s), and then delete them from the client accounts.

Because spin-offs often result in fractional shares of the new security, it is also important to understand how cash-in-lieu (of fractional shares) transactions are handled via the wizard.

In this section, you will learn about the following:

how the Spin-off Wizard determines the value and cost basis of the original security

how the Spin-off Wizard determines the value and cost basis of the new security

how to handle the cash transaction for fractional shares if I entered 0 for Cash in Lieu

how to handle the cash transaction for fractional shares if I entered a real price for Cash in Lieu, and

Cash-in-Lieu (of fractional shares) transactions are normally imported as distributions or deposits into Cash. The Cash in Lieu price is usually not provided by the company generating a spin-off. This is because this price is generated by the custodian, and is dependent on when the Cash-in-Lieu transactions are processed. Different Cash-in-Lieu prices often exist for different custodians. Sometimes you will even see different prices used within a custodian, if transactions are processed at different times.

In the Import blotter, cash-in-lieu transactions appear separate from spin-off transactions. These items should also be deleted, since the Spin-off Wizard will account for them.

The easiest way to locate and delete these transactions is to do the following:

Sort the Transactions blotter grid view by either the Ticker or Security ID column.

Scroll to locate the transactions for the new holding.

Review the Comments column for notations referencing Cash in Lieu.

Select and delete these records from the blotter.

The offsetting cash transaction for the distribution is automatically deleted when the distribution is deleted, so it is not necessary to export or delete the cash transactions. If only Cash Deposits were sent as the transactions, they will also need to be deleted.

What if the Cash-in-Lieu transactions/amounts have not occurred yet at the Custodian?

If no fractional shares resulted from the spin-off, it could be that no Cash-in-Lieu transactions occurred. If fractional shares did result from the spin-off, but the custodian is not listing a Cash-in-Lieu transaction, it could be that the transactions have just not yet occurred. These transactions can appear a few days after the initial spin-off transactions.

While working through the wizard, you can enter 0 in the Cash in Lieu Price field and add the price (or amount) later to the generated transactions. You can still post the data even though you may have transactions in your Cash in Lieu blotter which are not ready to be posted.

As long as the Cash-in Lieu transactions have a red triangle in the Status column, they will not post. When you post your data, these transactions will remain in your blotter until the price or amount is entered prior to posting. You can import future dates or import another custodian’s data without losing these transactions. Once you have an amount for these transactions, you can click in the Net Amount field to update the transaction.

To facilitate the process of reconciling and posting spin-off transactions, Morningstar recommends using the Corporate Action wizard from the Corporate Actions Warehouse window from within your normal custodian Import screen; this will allow you to reconcile the data. The wizard can be used during your normal import process.

Do the following:

At the top of the Morningstar Office window, click the Import icon. The Import window opens.

At the top of the Import window, click the Corporate Action Warehouse icon.

When the Corporate Action Warehouse window opens, click Corp Action in My Practice in the left-hand navigation pane to display corporate actions that are known to Morningstar.

Check the box next to the original security whose spin-off you want to reconcile with your clients’ holdings.

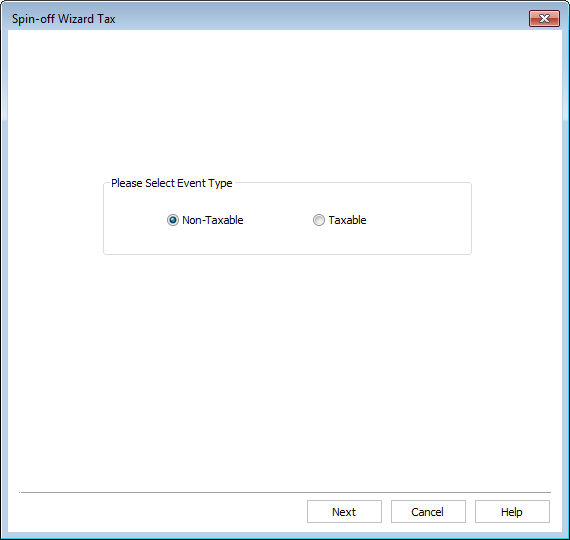

From the top menu, click Corporate Action Wizard. The Spin-off Wizard opens. The first screen in the Wizard will ask you for the Event type: Taxable or Non-Taxable. This will affect the transaction types used to create the Spin-off. Selecting Taxable will create Buy and Sell transactions, whereas selecting Non-Taxable will create Credit of Security and Debit of Security transactions. Click Next.

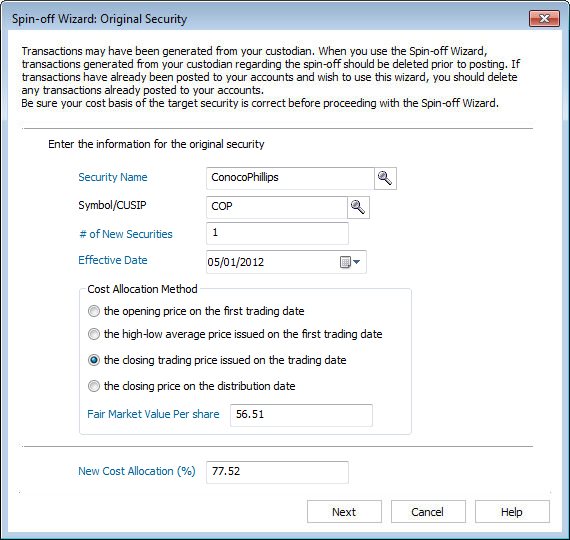

The Original Security screen fields will pre-populate, based on the information in the Corporate Action Warehouse database.

When all the fields are populated, click Next.

This screen contains information for the new security. Once again, all data entry fields in blue text are required. If you do not have the Cash in Lieu price, Morningstar recommends entering 0, and then correcting the generated transactions through the Cash in Lieu blotter.

Click Next to continue.

If a spin-off generates more than one new security, you will see another New Security page when you click Next. Otherwise, you are brought to the Select Which Portfolios page in the wizard.

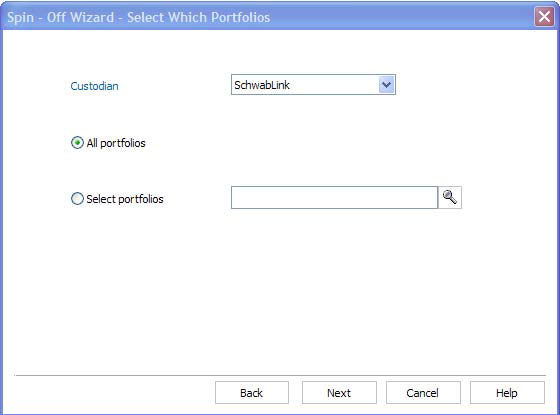

On the Select Which Portfolios screen, you need to select the Custodian and determine whether the corporate action will be applied to All Portfolios or Select Portfolios. All Portfolios is the default and is normally the option selected, unless you need to update only a specific portfolio.

Click Next to generate the transactions. You are taken to the Corporate Actions Blotter, where you can review the transactions.

If the accounts were imported from Microsoft Excel, it cannot be reconciled; you can simply post the transactions to your accounts.

The original holding has at least two transactions associated with it: a Debit of Security and Credit of Security. These transactions adjust the cost basis of the pre-spin off security.

If you had multiple lots within the original holding, you will have a Debit and Credit transaction for each lot.

The Debit of Security row records the following:

the number of shares from the original holding

the price per share, based on the date before the spin-off, and

the original cost basis per share.

The price per share is pulled from the Definition Master. If you have not made changes for this security, it will use the closing market price on the day before the spin-off.

The Credit of Security row for the original security should reflect the same number of shares as the Debit of Security, but the Price and Per Share Cost Basis are now based on the allocation percentage assigned to the original holding per the spin-off calculation.

Using the example above (see the screen shot under step 5 on page 6), the New Cost Allocation (%) entered for the original security was 77.52. This is the percent of the cost basis that will be retained by the original security. The wizard calculates the new price and per share cost basis based on the factors and values in the table below:

Item |

Value |

Number of shares of the original security |

37 |

Value of the Original Security |

$2,650.31 |

Original per share cost basis |

$2,861.95 |

New cost allocation for original security |

77.52% |

The new price for the original security is calculated as follows:

$2,650.31 (value of original security) x 77.52% (new cost allocation%) = $2,054.52031

$2,054.52031 / 37 (original shares) = $55.52758 (new price)

The updated cost basis for the original security is calculated as follows:

37 (original shares) x 77.35 (original per share cost basis) = $2,861.95

$2,861.95 x 77.52% (new cost allocation%) = $2,218.58

$2,218.58 / 37 (original shares) = $59.96172 (new per share cost basis)

A Credit of Security is also generated for the new security. The number of shares associated with the credit is determined by the Share Distribution Ratio entered in the wizard (see the screen shot under step 7 on page 7). In our example, it was 0.5 or ½ share of the new security for each share held in the original security. Since the client had 37 original shares, they now have 18.5 of the new security. The Net Amount, Price, and Per Share Cost Basis are calculated using the New Cost Allocation% (22.48) assigned to the new security through the wizard.

Note: the New Cost Allocation% assigned to the original and new securities must always equal 100%.

$2,650.31 (value of original security) x 22.48% (new cost allocation) = $595.7897

$595.7897 / 18.5 (new shares) = $32.20485 (new price)

If the corporate action resulted in fractional shares being sold, they will appear on the Cash in Lieu blotter, which can be accessed from left-hand side of the screen. Open the Cash in Lieu blotter to review the transactions for accuracy and possible updates before they are posted.

Based on the value you entered for the Cash in Lieu price when completing the wizard, see either “How do I handle the cash transaction for fractional shares if I entered 0 for Cash in Lieu?” on page 10, or “How do I handle the cash transaction for fractional shares if I entered a real price for Cash in Lieu?” on page 10.

If you entered 0 for the Cash in Lieu price in the Spin-off Wizard, the transactions appear on the Cash in Lieu blotter with a red warning. At this point, you can refer to the Cash in Lieu transactions you exported prior to deleting them to retrieve the Net Amount.

Morningstar recommends updating the Net Amount column rather than the Price column. Why? If the price is added and the calculated Net Amount value (Number of Shares x Price) results in a value with more than two digits after the decimal (18.756 instead of 18.76), this could result in incorrect values in the Cash account.

After entering the net amount in both the Sell and Deposit fields, click Save to have the system complete the transaction.

If you entered an actual price for Cash in Lieu as you completed the Spin-off Wizard, you need to check each transaction that appears on the Cash in Lieu blotter to make sure no extended values exist beyond the decimal place in the net Amount and Gross Amount fields.

For example, when looking at the Net Amount column, the value may appear to be 18.76, but if you click in the cell it could actually be 18.756. Morningstar recommends updating the value (if more than two digits appear after the decimal) in the Net Amount and Gross Amount columns, and clear the price value. When you save the changes, the price will recalculate.

Once you have verified/updated the transactions in the Cash in Lieu blotter, you need to reconcile. Reconciling will allow you to verify that the Corporate Action was done correctly. If you have Out of Balances, please refer to the out of balance FAQ.

See Also

See Also

FAQs for Spin-off Transactions