This document explains the calculation Morningstar Office uses when calculating the yield for user-defined securities. The following topics are covered:

understanding yield types and terms

calculating yield on price for user-defined securities

calculating yield for fixed- income securities, and

calculating the yield for a portfolio.

Overview

This section explains different types of yields for securities. The following terms are explained:

Current Yield

Yield to Maturity

Yield to Call

Yield to Put

Yield to Worst

Zero coupon (or strip) bonds, and

Clean prices vs. dirty prices.

What is Current Yield?

Current Yield is the annual income (interest or dividends) divided by the current price of a security. This measure looks at the current price of a bond (instead of its face value) and represents the return an investor would expect if the bond were purchased and held for a year. This measure is not an accurate reflection of the actual return an investor will receive in all cases, because bond prices are constantly changing in the market.

What does Yield to Maturity mean?

Yield to Maturity (YTM) is the rate of return expected for a bond if it is held until the maturity date. YTM is considered a long-term bond yield expressed as an annual rate. The calculation of YTM takes into account the following components:

current market price

par value

coupon rate and frequency, and

time to maturity.

Note: It is also assumed that all coupons are reinvested at the same rate.

What does Yield to Call mean?

Yield to Call is the yield of a bond if it were bought and held until the call date. (The call date is the date on which a bond can be redeemed before maturity. If an issuer feels it is beneficial to refinance the issue, the bond may be redeemed on the call date at par or at a small premium to par.) This yield is valid, then, only if the security is called prior to maturity. The calculation of Yield to Call is based on the following components:

the coupon rate and frequency

the length of time to the call date, and

the market price.

What does Yield to Put mean?

Yield to Put is the annual yield on a bond, assuming it will be put (that is, sold back to the issuer) on the first permissible date after purchase. Bonds are quoted in this manner only

Note: if they sell at a price below the Put price. Therefore, the yield includes both interest and price appreciation.

What does Yield to Worst mean?

Yield to Worst is computed by using the lower of Yield to Maturity, Yield to Call on every possible call date, or Yield to Put on every possible put date.

What is a Zero coupon (or strip) bonds?

A Zero-coupon bond is one that pays no interest. It is sold at a discount from par value, and matures at par. These investments are fairly illiquid, because they do not benefit from changes in interest rates. However, they do tend to be more sensitive to swings in interest rates. Also, since they pay no coupon, no re-investment risk exists.

Sometimes Zero-coupon bonds are issued as such; other times they are bonds stripped of their coupons by a financial institution and resold as Zero-coupon bonds.

What is the difference between a clean and a dirty price for bonds?

A “clean” price is the price of a coupon bond, excluding any accrued interest. A clean price is the discounted future cash flows, not including any interest accruing on the next coupon payment date. Immediately following each coupon payment, the clean price will equal the dirty price.

A “dirty” price, in contrast, is a bond price quote referring to the price of a coupon bond that includes the present value of all future cash flows, including interest accruing on the next coupon payment. The dirty price is how the bond is quoted in most European markets, and is the price an investor will pay to acquire the bond. This is also sometimes referred to as “price plus accrued interest.”

Overview

This section explains the calculations used for a number of different Yield on Price or 12-month Yield values. This section defines the Yield on Price calculations for the following user-defined security types:

bonds

cash and money market funds, and

equities, funds and other securities.

How is Yield on Price calculated for user-defined bonds?

For the calculation below, user-defined bonds could be one of the following securities:

Fixed Income

Collateralized Mortgage Obligations

Mortgage-backed securities

CDs, or

Treasury Inflation-Protected Securities.

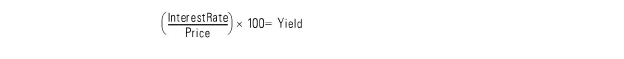

For these instruments, current yield on price is calculated as follows:

For example, if the interest rate is 5%, and the price is 98% of par value, the yield would be:

(0.05/0.98)*100 = 5.1%

How is Yield on Price calculated for user-defined cash or money market funds?

For user-defined cash or money market funds, Current Yield= Interest Rate.

For example, if the interest rate is 3%, then the yield is also 3%.

How is Yield on Price calculated for equities, funds and other securities?

For the following security types, a different calculation is used: for funds, the 12-month yield is used, and for stocks the dividend yield is used:

|

|

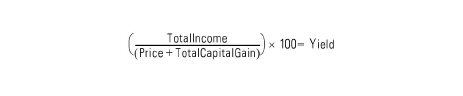

For these items, yield is calculated as:

How does the dividend history affect the Yield on Price calculation?

If dividend history is available for the past 12 months, then the following rules apply:

Total Income is the total dividend amount whose ex-date occurred in the past year.

Total Capital Gain is the total long-term capital gain and short-term capital gain whose ex-date occurred during the past year.

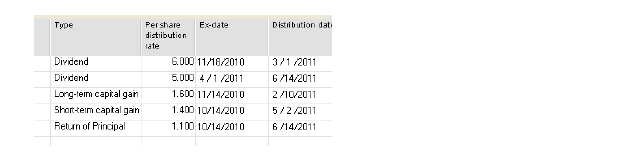

As an example, consider the following screen shot for a fund:

On 10/31/2011, the fund price is $30.

The Ex-date is between 11/1/2010 and 10/31/2011, so the dividend is 6 + 5.

Capital gain is 1.6

The yield at 10/31/2011 should then be:

[(6+5)/(30+1.6)]*100=34.8101

How is Yield on Price calculated if the dividend history has not been entered?

If the dividend history for a user-defined security has not been entered, the dividend rate is used. For example:

Total Income = (Distribution Per Share* Number of dividends payments per year)

Total capital gain=0

Distribution Per Share =0.6, Frequency is Quarterly, Price on 10/31/2011 is 30.

Yield= ((0.6*4)/(30 + 0))*100 = 8%

Overview

In Morningstar Office, the reports related to portfolio accounting (Portfolio Snapshot, Portfolio Current Value, Portfolio Fixed Income report), and the yield of fixed income securities, follow the report settings you choose. This section explains how different types of yield are calculated for fixed-income securities in Morningstar Office.

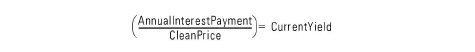

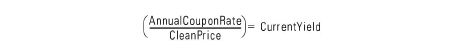

How is Yield on Price calculated for a bond’s Current Yield?

Using Yield on Price, the Current Yield for a bond is calculated as follows:

Alternately, the following calculation can be used:

For example, consider the calculation for current yield on 8/15/2011 for a bond with the following characteristics:

par value = $100

coupon rate = 5.00%

price = 95% of par value.

0.05/0.95 = 0.05263 (converted to a percent value, 5.263%)

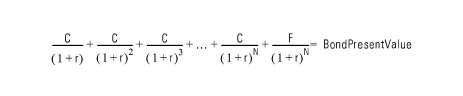

How is a bond’s Yield to Maturity calculated?

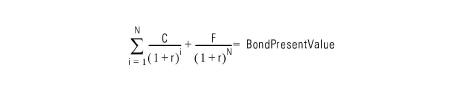

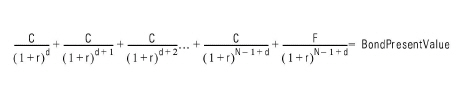

Using discounted cash flows on the coupon date, a bond’s valuation is calculated as follows, where:

C =Coupon payment

F= Face value at maturity

N = Number of coupon payments to maturity, and

r = Return for the coupon period

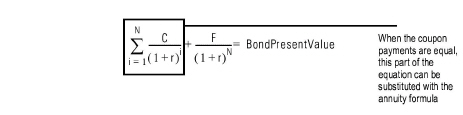

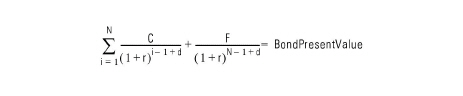

Or, in short form:

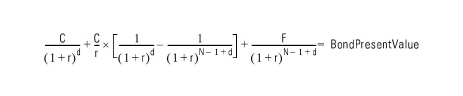

When the coupon payments are equal, part of the equation can be substituted with the annuity formula.

F An annuity formula

assumes a regular payment

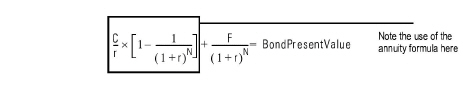

In that case, the calculation becomes:

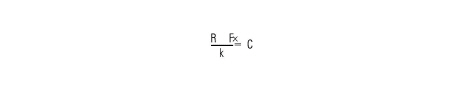

For the Yield to Maturity calculation for days other than the coupon payment date, the following variables are used:

C =Coupon payment

d =Days from value date to next coupon date divided by the number of days in the interest payment period

F= Face value at maturity

k = the number of coupon payment per year

N = Number of coupon payments to maturity

r = Return for the coupon period

R = the annual coupon rate of the security.

In that case, the coupon payment calculation is:

The Yield to Maturity is calculated by the Annual Percentage Rate (APR) method:

For a bond’s valuation between coupon dates, the formulas assume the following format:

Or, in short form:

In annuity format:

A bond’s present value, or dirty price (expressed in amount), can be calculated as:

Bond present value = Bond clean price (expressed in amount) + Accrued interest

These equations can be used to deduce a bond’s Present Value or Price with known yield, and they can also be used to determine the Yield to Maturity with a known price by trial-and-error.

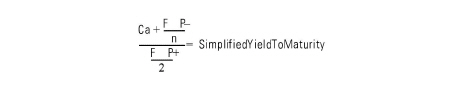

When solving for Yield to Maturity by trial-and-error, the first guess used could be the simplified yield to maturity (SYTM). The following variables are used to calculate this value:

Ca = the annual coupon payment.

F= Face value at maturity

n = number of years to maturity, and

P = the dirty price.

You can also start the trial-and-error method with the Current Yield or coupon rate.

How is Yield to Call calculated?

For Yield to Call, Morningstar Office uses the first call date (instead of the maturity date) in the above formulas with the following terms:

F = the redemption value received at first call date, and

N = the number of coupon payments to the first call date (rather than maturity)

How is Yield to Put calculated?

For Yield to Put, Morningstar Office uses the first put date (instead of the maturity date) in the above formulas with the following variables:

F = the redemption value received at first put date, and

N = the number of coupon payments to first put date (rather than maturity).

How is Yield to Worst calculated?

Yield to Worst is calculated as the lowest of yields to all call dates, or to put dates or the yield to maturity.

Other yield calculations

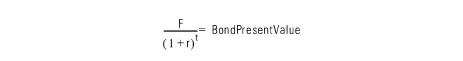

For Zero coupon (or strip bonds), the first part of the equation in the bond valuation formulas becomes 0, and the yield formula is reduced to the following, where t = the number of years to maturity (which can be fractional), and r = Yield to Maturity:

For a perpetual bond the following formula should be used:

Note: For a municipal bonds, the Yield To Maturity obtained from the above formulas are tax-free yield. Tax-equivalent Yield should be used to compare directly to a yield of that of a taxable bond. The formula is: Tax-Equivalent Yield = Tax-Free Muni bond Yield / (1 – tax rate).

How is Current Yield on Cost calculated?

To calculate Current Yield on Cost, Morningstar Office first calculates the yield for each open lot: The cost of an open lot on report date (should be percentage value) is used to replace the price on report date in the above formulas. Then, the application uses the weighted average (by share) of different lots.

How is Yield to Maturity on Cost calculated?

Yield to Maturity on Cost is a constant value for each lot. The calculation works as follows:

Find all open lots as of a report date.

Find the original purchase date and cost of a lot.

Aggregate the cash flow (both the cost and payment amount from the earliest purchase date to Maturity date).

Calculate the yield from the earliest purchase date (For deliver-in/debit of security/merge in, the trade date will be used) to maturity date.

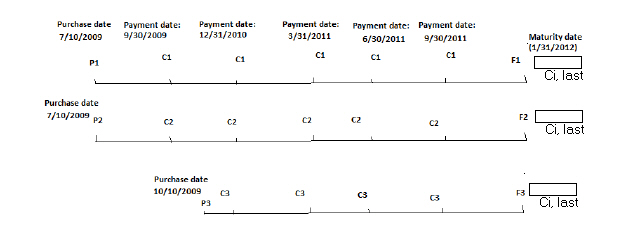

For example:

To calculate Yield to Maturity on Cost for fixed income A on 8/10/2011, with three different open lots, frequency is quarterly, final coupon date is 9/30/2011, and the maturity date is

1/31/2012.

The data point calculation used in the discount cash flow formula is:

|

Present Value P |

Cash flow amount C (Interest Amount) |

Final Amount F (Face value) |

Date |

|

P1+P2 |

|

|

7/10/2009 |

|

|

C1+C2 |

|

9/30/2009 |

|

|

-P3 |

|

10/10/2009 |

|

|

C1+C2+C3 |

|

12/31/2010 |

|

|

C1+C2+C3 |

|

3/31/2011 |

|

|

C1+C2+C3 |

|

6/30/2011 |

|

|

C1+C2+C3 |

|

9/30/2011 |

|

|

|

|

1/31/2012 |

|

|

|

F1+F2+F3 |

1/31/2012 |

Pi (i=1,2,3): Cost plus accrued interest of this lot at trade date.

Ci /Ci, last (i=1,2,3): Coupon payment/last coupon payment.

Fi (i=1,2,3): Face Value at maturity date.

In this case, to Calculate Yield to Maturity on Cost on 8/11/2011, the following would be done:

Find the open lots.

Find the trade date of these lots.

Define the period: 7/10/2009~1/31/2012.

Input the data points (per the matrix in the above table).

Use the discounted cash flow method to calculate the return.

Convert this value to a percent. For example, if the return is 25%, then yield is 25.

Overview

This section explains how Morningstar Office calculates the yield for a portfolio (rather than an individual security).

What is portfolio yield?

Portfolio Yield is the weighted average of the yield of the holdings in a portfolio. For the yield of a holding, the respective yield in the following is used:

12-Month Yield for funds

Dividend Yield for stocks, and

Current Yield or YTM for fixed-income securities (depending on the Bond Yield Settings in the report).

The holding Yield logic is as follows:

When configuring report settings, the Bond Yield setting will apply to the following:

Fixed income

CD

CMO

MB, and

TIPS.

Note: If the report setting is YTM on Price or YTM on Cost, the yield data is dashed on the report for CMO, MB, and TIPS.

For the user-defined security yield calculation, please see page 4.

What inputs are required for this calculation?

To make this calculation, the following inputs are required:

the current 12-month yield for each holding in a portfolio (input by the user), and

Note: For preferred stock, a user should use Current Yield.

the weight of each holding in the portfolio.

The current yield comes from the Morningstar Office database; the weighting may come from the database (based on the user’s input), or it may come from a previous calculation of a holding’s weighting.

All data points (input and output) are to two decimal places. The calculation (shown below) results in the Portfolio Trailing 12-Month Yield.

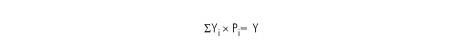

What is the algorithm for the Portfolio Yield calculation?

A portfolio’s yield is calculated as follows:

Calculate the weight of each holding in the portfolio.

The weight of each holding is then multiplied by the yield of each holding.

Results for all holdings in the portfolio are summed.

Where:

Pi = the weight of each holding in the portfolio

Y = Portfolio Trailing 12-Month Yield, and

Yi = Yield of holding i (if no yield value, it is calculated as 0).