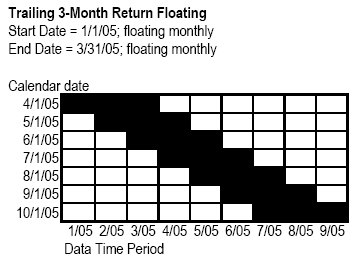

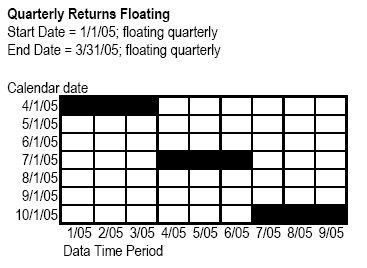

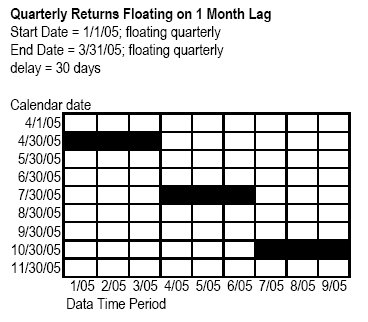

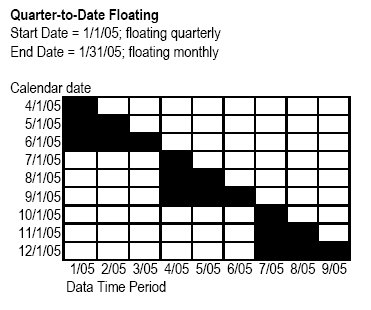

To change the Title, Start date, End date, Rolling window, Confidence region, Currency, and Constraints. Start date and End date set the time period for the analysis. By default End date is set to the most recent month-end, and the Start date is set to End date minus 60 months. You can float either date on a monthly, quarterly, semiannually, or yearly basis and also build lag time into the calculation. See below for some examples of how to create floating data points.

Trailing 3-Month Return Floating

Quarterly Returns Floating on 1 Month Lag

Rolling Window sets the time period for each RBSA calculation within your analysis start and end date.

The constraints area allows you to manipulate the constraints place on the RBSA. Include long only forces all results to be > 0. You cannot change this amount. Include long & short allows results to be less than 0. For instance, 50% shorting places the lower boundary at �50 instead of 0. For this selection, you will be able to enter a value in the text box.